High-Income Realty Investing: Approaches for Maximizing Returns

High-income realty investing is a strategy that focuses on homes and financial investments that create significant cash flow and solid long-lasting returns. Whether you're a experienced investor or new to the real estate market, comprehending the nuances of high-income realty can assist you optimize your incomes and construct substantial wide range. This short article discovers key strategies, types of residential or commercial properties, and tips for successfully navigating the high-income real estate market.

What is High-Income Property Spending?

High-income property spending includes getting and handling homes that create higher-than-average rental earnings or resources recognition. These residential or commercial properties can vary from multi-family apartment to industrial real estate, deluxe services, and short-term getaway residential or commercial properties. The goal is to generate significant monthly capital while likewise benefiting from property admiration over time.

Trick Methods for High-Income Real Estate Spending

1. Focus on High-Yield Rental Residences:

Among the most reliable methods to achieve high revenue from realty is to invest in rental buildings that provide high returns. This commonly includes multi-family properties, apartment, and student real estate in high-demand areas. By obtaining residential or commercial properties in locations with solid rental need, you can make certain a steady stream of earnings and higher returns on your investment.

2. Purchase Commercial Real Estate:

Business property, consisting of office buildings, retail areas, and commercial residential properties, typically provides higher revenue capacity than properties. These financial investments come with longer lease terms, which can result in a lot more stable and predictable income streams. In addition, commercial lessees are typically responsible for building expenditures such as maintenance, tax obligations, and insurance policy, reducing your general prices and increasing net income.

3. Explore Short-Term Getaway Leasings:

Temporary trip rentals, especially in popular traveler locations, can supply incredibly high returns. Platforms like Airbnb and VRBO have made it simpler to manage and market these homes, enabling financiers to maximize occupancy rates and rental income. While short-term rentals require even more hands-on management, the possibility for high every night prices and raised earnings can make them a financially rewarding alternative for high-income investor.

4. Take Into Consideration Deluxe Realty:

High-end residential properties, whether in metropolitan centers or exclusive vacation spots, cater to high-net-worth people and can create considerable rental earnings. These residential or commercial properties frequently command costs rental prices, particularly in desirable areas with high need. Purchasing luxury property calls for a considerable upfront financial investment, however the prospective returns can be substantial, specifically when handled effectively.

5. Make Use Of Value-Add Methods:

Value-add investing involves acquiring residential properties that need enhancements or restorations to raise their worth and rental income possibility. By upgrading devices, improving amenities, or boosting home management, financiers can significantly enhance the residential or commercial https://greenspringscapitalgroup.com/ property's market price and rental earnings. This approach is especially reliable in high-demand areas where restored residential or commercial properties can regulate higher leas and attract preferred lessees.

Types of High-Income Property Investments

1. Multi-Family Characteristics:

Multi-family buildings, such as duplexes, triplexes, and apartment complexes, are prominent amongst high-income investors because of their possibility for stable capital and scalability. With numerous units, these homes give diversified earnings streams, lowering the threat associated with occupant openings.

2. Business Real Estate:

As discussed previously, business property investments can generate higher returns due to longer lease terms and greater rental prices. Office, retail centers, and industrial residential properties prevail types of commercial real estate that appeal to high-income financiers.

3. Short-Term Rentals:

Short-term leasings in high-demand places, like beachfront residential properties or city facilities, supply the possibility for high revenue via every night or once a week prices. These residential properties take advantage of high occupancy rates during peak travel seasons, leading to substantial earnings generation.

4. REITs ( Property Financial Investment Trusts):.

For those seeking to invest in high-income real estate without straight possessing residential properties, REITs High-income real estate investing supply a method to purchase income-producing real estate assets. REITs offer the benefit of liquidity, as they are traded on major stock exchanges, and they distribute a substantial section of their earnings to investors in the form of dividends.

5. Industrial Feature:.

The surge of ecommerce has driven need for commercial homes, including warehouses, warehouse, and satisfaction centers. These buildings are frequently rented to big corporations under lasting contracts, supplying secure and high rental revenue.

Tips for Effective High-Income Real Estate Spending.

1. Conduct Thorough Market Research:.

Recognizing the neighborhood property market is important for determining high-income possibilities. Evaluate rental need, job prices, and property values in potential investment areas. Focus on regions with strong economic development, job opportunities, and populace rises, as these elements drive need for both property and industrial residential or commercial properties.

2. Utilize Financing Purposefully:.

Using take advantage of effectively can magnify your returns on high-income property investments. Nevertheless, it's essential to guarantee that your rental revenue can cover mortgage repayments and various other expenses, leaving space commercial. Work with monetary consultants and mortgage brokers to secure desirable financing terms that sustain your investment technique.

3. Expand Your Portfolio:.

Diversifying your property portfolio across different residential property types and locations can help alleviate risk and boost total returns. By purchasing a mix of property, business, and short-term rental residential properties, you can develop a well balanced profile that performs well in various market conditions.

4. Focus on Renter High Quality:.

Occupant high quality straight affects the earnings possibility of your service buildings. Display High-income real estate investing lessees extensively to guarantee they have a solid rental background, steady earnings, and great credit score. High-grade lessees are most likely to pay lease on time, take care of the property, and remain lasting, minimizing turnover costs and openings rates.

5. Keep Informed on Market Trends:.

The realty market is regularly developing, with trends in modern technology, demographics, and financial aspects influencing need and building worths. Stay informed concerning these patterns to identify emerging chances and adjust your investment strategy appropriately.

High-income realty investing offers a path to significant wide range build-up and financial freedom. By focusing on high-yield rental properties, industrial real estate, temporary getaway services, and value-add chances, capitalists can produce significant earnings and lasting recognition. Success in this area needs thorough marketing research, strategic funding, profile diversification, and a concentrate on renter top quality. Whether you're simply starting out or aiming to broaden your existing profile, high-income real estate investing can be a effective device for building a flourishing financial future.

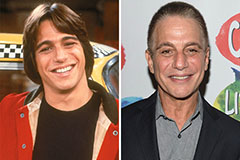

Tony Danza Then & Now!

Tony Danza Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!